According to a new study, released this month by analyst firm Nucleus Research, organizations that invest in analytics solutions, such as Business Intelligence (BI) software, are experiencing average returns of $13.01 for every dollar spent in 2014.

But, as implausible as these results seem, Nucleus Research has in fact discovered that analytics ROI is also on a sharp upward trend.

A similar Nucleus Research study, analyzing the successes of 60 separate analytics implementations, reported an average ROI of $10.66 for each dollar spent in 2011.

“With all the changes that have happened in the market in the past three years, Nucleus again looked at case studies published since 2011 to determine if vendor investments in new analytics capabilities have paid off in terms of delivering more ROI to customers,” stated the report. “In looking at the case studies published since our last analysis, Nucleus found that for every dollar a company spends on analytics, they now get back $13.01 – 1.2 times more than they got just three years ago.”

Nucleus said that these conclusions were reached after a thorough analysis of all Nucleus Research analytics case studies since November 2011, and included a breadth of deployment sizes, types as well as major and smaller vendor solutions.

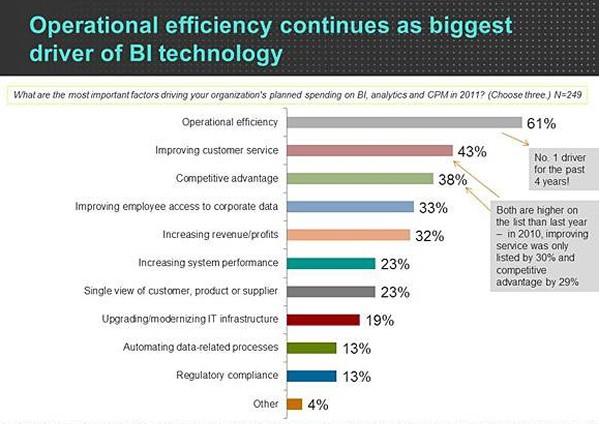

Drivers: Need for data transparency, faster decision-making, competitive advantage and emergence of new technologies

The Analytics Pays Back $13.01 for Every Dollar Spent research note cited the need for greater data transparency, faster time-to-action in highly competitive markets, and improved processes driven by fact-based decision-making as the major drivers spurring heightened BI investment.

“Over the past three years, organizations continued to recognize the need for improved visibility and productivity,” stated the report. “Existing business processes are no longer meeting the demand for quick, usable, and reliable insights for business decisions.”

Nucleus Research concluded that, due to increasingly crowded markets across all major industry segments, organizations “can no longer afford to wait weeks for reports on profitability, revenue, budgeting and forecasting, [or] delay marketing campaigns.”

Tough competition within the BI market – leading to the creation of a multiplicity of niche vendors and development of new innovate technologies focused on harnessing Big Data and cloud-based deployment – was also linked to increased adoption and ROI.

“New vendors have also entered the market in the past three years, with both niche and smaller vendors offering high levels of usability, integration into other systems, competitive pricing strategies, and ease-of-deployments that reduce the need for hardware, IT resources, as well as the overall cost of software,” stated the report. “Larger vendors are following suit to remain competitive, and many have adjusted packaging, pricing, and product capabilities to match those of the up and coming new vendors. Customers now have a much greater choice of vendors and deployment types, enabling them to reduce IT dependency via the cloud while sourcing the lowest cost, most functional options for solution deployments.”

Challenges and inhibitors

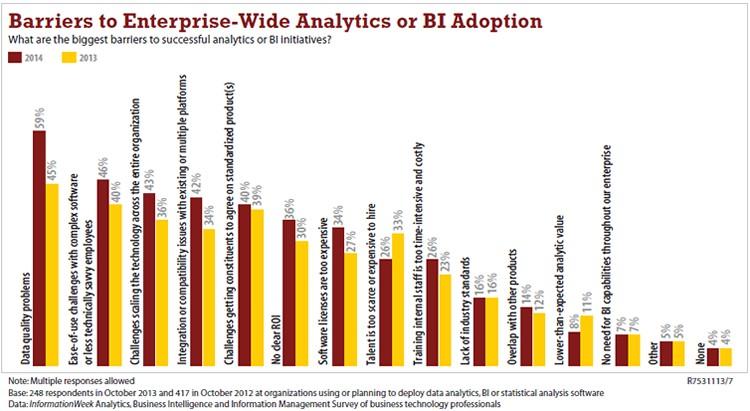

According to Nucleus Research, data quality and transparency also remain consistent barriers to effective BI programs, trustworthy reports and therefore BI ROI.

“One of the biggest challenges still facing organizations is the lack of visibility to data – the one version of the truth,” said the report. “Many of these organizations have siloed data systems, multiple sources of information, and complex, manual processes of data consolidation.”

Additionally, manual processes related to data manipulation, collation and preparation continued to act as an inhibitor towards greater productivity – even within organizations with well-established BI initiatives. The report pinpointed this area as something that BI-using organizations, and technology vendors alike, could improve upon to continue to boost BI ROI.

“Even with the availability of analytical applications, organizations continued to rely on manual processes for reporting, data consolidation, analysis, planning, budgeting, and in the financial close,” read the report. “Many hours and resources were dedicated to the manual compilation and validation of information and data within spreadsheets. Additional hours are also committed to the processes around incorporating that information into the systems of record.”

Despite the well-publicized benefits of reporting and analytics, joint research from the Economist Intelligence Unit and consulting firm PwC indicate that many executives still rely on experience and intuition when making crucial business decisions – even disregarding data-based insights in the process.

This culture of decision-making remains another strident challenge to BI adoption and ROI. The report revealed that senior executives still relied on “intuition” and the “advice and experience of others” when taking critical action the majority of the time. These personal judgments formed the underpinning methodology behind decision-making 58% of the time. Of the 1,135 executives who participated in the global survey conducted in May 2014, only one-third said that they relied “primarily on data and analytics” when undertaking their most recent significant decision-making process. Despite this, it’s also clear that business leaders understand the capacity of BI technology to assist the decision-making process, with all survey respondents stating that investing in better data analysis was a top priority over the next two years.

“A company’s success today is tied to how good it is at making big decisions,” said PwC’s Global and US Data and Analytics Leader, Dan DiFilippo. “While executives say they continue to rely on experience, advice or their own gut instinct, they also see investment in data and analytics as critical to success. Experience and intuition and the use of data and analytics are not mutually exclusive. The challenge for business is how best to marry the two.”

Benefits

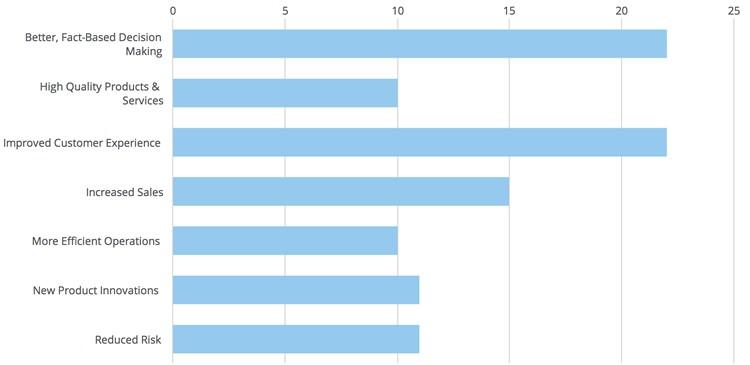

With many of the significant barriers to BI ROI well known, the benefits – according to Nucleus Research, include the ability for analytics applications to “improve the effectiveness of business processes, to increase visibility, to drive greater business profitability, and to drive greater productivity and results”.

Source: BusinessIntelligence.com

Nucleus Research also concluded that further adoption of BI technology, and a culture of analytics-based processes and decision-making, also had the ability to assist organizations to:

- Eliminate the manual requirements of business processes and sources dedicated to report building, and therefore reduce operating costs

- Consolidate and collaborate effectively around data

- Improve the trustworthiness and transparency of information, and therefore confidence, in the decision-making process

- Improve organizational visibility by breaking-down information silos and creating uniform standards for reporting throughout the enterprise – across departmental divides, functional business areas and previously disparate business systems (ERP, CRM, etc)

- Make better, faster strategic and operational decisions

- Improve organizational and individual productivity by re-allocating resources previously involved in manual data processes, to “revenue-driving business activities”, leading to increased operating profits and customer satisfaction

Patterns: More use cases, more BI tools and more data

The report also found that as the potential benefits of BI become better publicized within the BI industry, and socialized throughout an organization, reporting and analytics would continue to break out of more traditional IT-controlled deployments and financial-oriented use cases, spreading to new parts of the business.

“Analytics are being implemented to streamline and automate decision-making and reporting and are increasingly being extended to other operational areas such as CRM, ECM, HCM, and ERP,” said the report. “Customer leveraging of analytics is increasing the relevance of the market to become an operational cornerstone for success, as BI becomes a platform for cross-operational analysis, able to piece together the big picture for operations management.”

The study indicated that, given the emergence of new and multiple use cases within a single organization, it was also increasingly likely that many businesses would become home to multi-tool deployments: “Many companies have seen the gains made in different parts of their organizations through analytics, and are looking to complement existing implementations with additional tools.” The report also argued that “With the increased competitiveness in the market, customers are able to find solutions that are driving greater ROI, providing improved collaboration, usability, mobility options, and more competitive pricing options.”

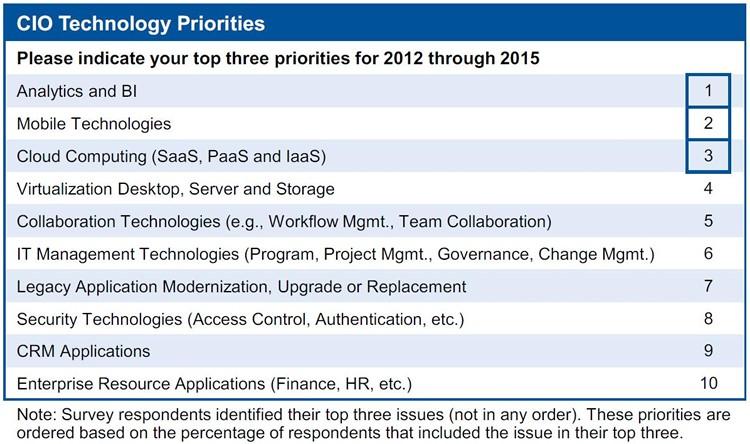

As with recent research published by Gartner, Nucleus Research has also articulated an interesting shift in BI purchase habits and patterns. With many more business functions looking to harness the decision-making capabilities of reporting and analytics solutions, in conjunction with the development of business-user-oriented technology, heads of department and business leaders (as opposed to IT) are playing an increasingly large role in the BI purchase and procurement process.

The report also cited the fact that – aside from reduction in initial purchase and deployment barriers – many vendors are now offering a broader range of purchasing options as another reason behind “the ability for business to purchase BI solutions with lower implementation costs as well as reduced IT requirements”.

The other major pattern detected and discussed in the study was the fact that the continued development of the Big Data phenomenon is driving significant investment, due to a number of key factors:

- Organizations have an increasing desire to exploit more data types and sources, and larger data volumes in general, for the purpose of reporting and analytics and decision-making

- The proliferation of existing data sources, and the creation of new ones, is producing more complex reporting and analytics requirements

- The rapid development of new tools capable of processing and analyzing increasingly larger and more varied data sources and types

“As the need to deal with greater volumes of data and disparate data sources grows, [in conjunction with] increased demands from business users for access, organizations are turning to analytic solutions and applications to deal with these pressures,” stated the report.

Increased prevalence of ROI use cases driving stronger investment

So, is it a case of the emergence of more ROI use cases spurring greater investment in business analytics, or is that stronger spend within the industry is responsible for organizations yielding better results? Perhaps the answer is both.

According to a recent industry study by MarketsandMarkets – titled “Business Intelligence Market by Types, by Function, by Deployment, by Features, by Verticals, by Organization Size, by Regions: Worldwide Trends, Market Forecasts and Analysis (2013 - 2018)" – the global BI market is set to grow at an estimated Compound Annual Growth Rate (CAGR) of 8.3%, increasing from $13.9 billion in 2013 to $20.8 billion by 2018.

Source: Forbes.com

Intriguingly, a recent report from Technology Business Research (TBR) suggested that the international BI software market would in fact exceed $40 billion by 2018, despite indications suggesting that market growth was actually slowing. According to TBR’s Business Intelligence Software Vendor Benchmark study, “customers’ BI software consumption patterns are maturing and broadening, with customers moving from stand-alone tools to packaged BI applications and then to analytic complements of business applications.”

What’s particularly noteworthy though is that this report clearly estimates the global BI market to be developing from a much higher base, with TBR forecasting a modest average year-to-year growth rate of four percent between 2013 and 2018 – a “slowdown from the double-digit growth rates of 2011 and 2012 that reflects the rising maturity of this market and the extent to which customers can extend BI software deployments”.

This rising maturity, resulting in more widespread and sophisticated BI deployments and use cases, might go some way to explaining the results of an industry report released by IDC last month. The IDC investigative study expects the global business analytics services market to total $51.6 billion by the conclusion of 2014, reaching $89.6 billion during 2018 – representing a strong 14.7% CAGR.

Senior research analyst for IDC, Ali Zaidi, told information-management.com that "Talent shortage, coupled with the high interest in adoption of new technologies, will continue to drive growth in business analytics services spending at the worldwide level.”