By Lachlan James and James Polasek

You know that the world is a diverse collection of cultures, climates and customs. No one place is identical to any other. What’s particularly interesting is the way in which different countries or regions approach the same problem – be it social, economic, political or environmental; adopt the same technology; or interpret the same event.

We view and interpret our world – as well as the instances, surroundings, circumstances, objects and individuals within it – through the contextual lens of our respective environments.

So how does geography relate to the Business Intelligence (BI) industry? How does location impact BI adoption, penetration rates, usage, goals and ambitions?

Dresner Advisory Services’ (DAS) Wisdom of Crowds Business Intelligence Market Study enters its fourth year of publication in 2013, again commentating on the critical trends and key players in the BI arena.

The study provides insights into the current BI marketplace from a number of perspectives, including by geography – identifying trends by region.

BI penetration by geography

When analyzing the penetration of BI (as a percentage of the total number of employees within an organization), North America is the frontrunner, with almost 20% of organizations from that region currently delivering BI to 81% or more of their employees.

The EMEA region (Europe, Middle East & Africa) experiences the second highest rate of penetration, with 17% of EMEA organizations making BI accessible to over 80% of its employees. Asia Pacific rates a close third (15%), while only 8% of Latin American organizations deliver BI to 81% or more of their staff.

Functions driving BI deployment by geography

When exploring the key job functions driving BI by geography, the report reveals that Executive Management as the group primarily fueling demand for BI programs.

Survey participants were ask to rate the influence that different business functions – Executive Management, IT, Marketing, Manufacturing, Finance, Sales and the BI Competency Center – had on their BI programs. Answers were ranked on a five point scale, with respondents stipulating whether each listed department was “always”, “often”, “sometimes”, “rarely” or “never” involved in driving BI initiatives.

All geographies, with the exception of Latin America, ranked Executive Management as the most powerful force, by job function, pushing for BI capabilities.

As a departmental driver, Executive Management was awarded a weighted average of between 3.9 and 4.3 out of a possible five (see figure above). Interestingly, Latin America rated the influence of Executive Management the highest of any major geography – awarding its influence a weighted mean of 4.3, but considered the impact of its sales team to be even stronger (4.35).

While the influence of the senior executive team on BI projects is pronounced throughout the world, the report discovered that the authority of other functional areas varied more so by geography.

In North American businesses, IT plays a prominent role in BI initiation and implementation, rated the third biggest influencer (3.5), sitting narrowly behind the finance and executive departments. Conversely, IT was rated as only the forth-biggest BI motivator elsewhere in the world – APAC (3.35), EMEA (3.4), Latin America (3.95).

As flagged earlier, sales is cited as a prevalent BI backer in Latin America (4.35) – the only region to rate its sales team as the biggest BI stimulant. The power of the sales function as a BI persuader is notably diminished in other parts, with APAC (3.8) and EMEA (3.6) rating sales as the third likeliest to incite BI action. North American (3.35) organizations considered sales the fourth strongest departmental force spurring BI deployment.

Curiously, aside from the BI Competency Center, Latin America rated the impact of all departments higher compared to any other region. For example, while no geography considered manufacturing to carry much weight at the BI decision-making table (all regions rated the group as the least influential department graphed), Latin America still considered it to be significantly more influential by comparison (2.7 out of five). North America rated manufacturing a mere 1.8 as a driving force behind BI implementation. Organizations in EMEA found manufacturing to be a slightly more frequent BI proponent (2.2), with APAC rating it a faintly stronger BI propellant still (2.3).

So, is it possible to deduce any insight from this trend? Perhaps BI implementations are more collaborative projects in Latin America? Or, maybe the need for business analytics is more frequently instigated by a specific departmental need? What does this mean for the rest of us? Are BI deployments comparatively reliant on a top-down approach elsewhere – dependent on securing reliable executive sponsorship?

Targeted BI user groups by geography

When examining the types of users targeted by BI deployments by geography, a relatively consistent pattern emerges – Executives and Middle Managers immediately standout as the predominant recipients of BI technology across all regions. Likewise, Middle Managers are identified as a close second priority for all geographies.

In fact, intriguingly, the importance placed on each subsequent user group is relatively comparable between geographies. Respondents from each geographic grouping considered, almost without exception, the ability to deliver BI to Line Managers to be the third highest priority, with Individual Contributors & Professionals fourth and Customers fifth. Providing suppliers with access to reporting and analytics was the lowest priority across the board.

The greatest variation in BI user group priorities, by geography, was amongst the Individual Contributors & Professionals user group. North American survey participants bestowed a weighted mean of 2.14 on this potential user group, compared to 1.82 from Latin American organizations. Similarly, the ability to provide customers with access to BI was perceived as most important by North American partakers (1.87), with Latin American (1.62) respondents again viewing this group as a lesser priority compared to other geographies.

Is it possible to explain this variation in mindset by the fact that, arguably, North America is the most developed BI market and Latin America the least? Is it conceivable that only the most mature BI environments are capable of implementing customer-facing analytics?

BI objectives by geography

When assessing BI objectives by geography, the study found that “better decision-making” was the universal top priority.

North America (4.2) placed the greatest comparative emphasis on “improved operational efficiency” – a clear second-placed objective. EMEA also listed improved operational efficiency as the second benefit sought from BI implementation, but deemed it much less important, scoring it a weighted mean of 3.8 out of five.

Once again the disparity between North and Latin America was emphasized in these particular findings, with Amérique latine the only region to rate “growth in revenues” higher than “improved operational efficiency”.

Future BI penetration rates by geography: 2014 plans

We’ve now got a feeling for how vigorously different regions have embraced BI to date, what’s pushed them to do so, which type of decision-makers are the chief benefactors, as well as the perceived value of analytics initiatives. But what of future plans? Do certain regions have more ambitious expansion plans than others?

Latin American organizations have enormously imposing plans, with 100% of businesses from that region – up from 55% today – expecting at least 11% of employees to have access to BI capabilities. Further, 76% of companies from Latin America said they intended to provide reporting and analytics technology to 21% or more of their staff.

Comparatively, some 97% of organizations from EMEA plan to distribute BI software to at least 11% of their workers. Ninety-six percent of North American businesses aim to match that pledge, while 92% of APAC companies intend to do the same.

But, are these impressive plans realistic? It’s undeniable that BI has been popularized and consumerized to a large extent, prompting more widespread deployments and user adoption. However, the slightly less ambitious future implementation plans of more developed BI markets, such North America, seem more likely to be realized.

Individual countries leading the charge for APAC include Australia, New Zealand and Japan, while the more developed countries within EMEA – such as Belgium and the United Kingdom, harbor the most capacious plans for 2014.

Where to now?

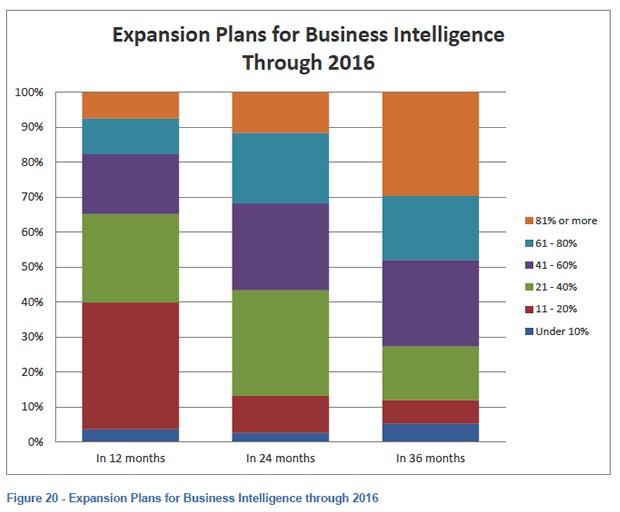

Looking beyond 2014 and geographic boundaries, global BI penetration rates seem set to increase significantly. Organizations – throughout the world – clearly want to provide BI capabilities beyond those that are currently in place. Presently, a minority of employees have access to BI, with 35% of the study’s total respondents citing that “Under 10%” of their workforce have BI tools at their disposal. But, as organizations continue to realize the enhanced ROI attainable via widespread BI deployments and high levels of user adoption, that figure seems set for dramatic change.

By 2016, it’s expected that 30% of organizations will provide BI to 81% or more of their employees.

These figures indicate the intention to significantly increase the number of BI implementations, and the number of users within existing BI initiatives, over the coming years.